All Categories

Featured

Table of Contents

Variable annuities have the capacity for higher earnings, but there's even more risk that you'll shed money. Be careful concerning placing all your properties into an annuity.

Take time to decide (define equity indexed annuity). Annuities marketed in Texas must have a 20-day free-look period. Substitute annuities have a 30-day free-look duration. During the free-look duration, you might terminate the agreement and get a complete refund. A monetary adviser can aid you assess the annuity and compare it to other financial investments.

Whether you'll lose any type of benefit interest or functions if you provide up your annuity. The guaranteed passion rates of both your annuity and the one you're considering changing it with.

See to it any type of representative or company you're thinking about purchasing from is accredited and solvent. new york life guaranteed lifetime income annuity ii. To validate the Texas license standing of a representative or business, call our Aid Line at 800-252-3439. You can likewise utilize the Company Lookup feature to discover a firm's monetary score from an independent rating company

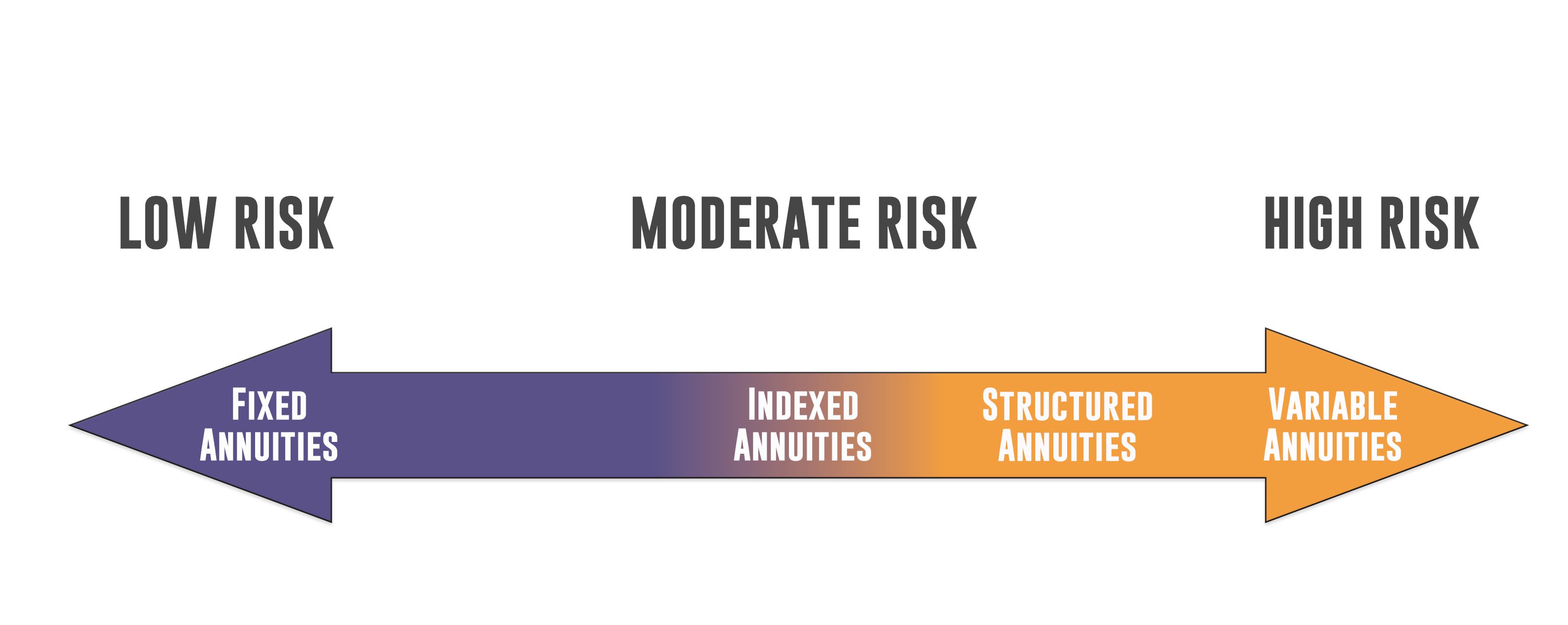

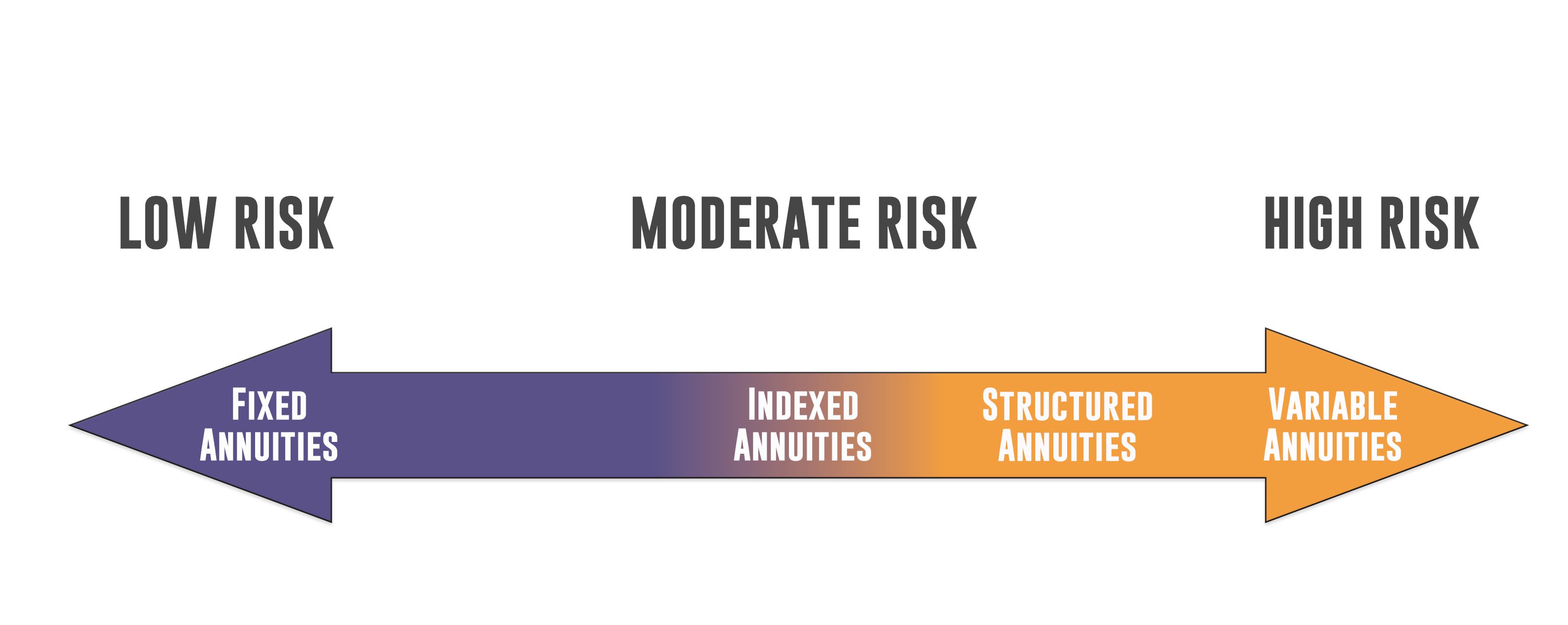

There are three kinds of annuities: repaired, variable and indexed. With a fixed annuity, the insurance firm assures both the price of return (the passion rate) and the payout to the capitalist.

How Much Are Annuities Paying

With a deferred set annuity, the insurer consents to pay you no much less than a defined rate of passion as your account is growing (annuity purchase rates). With a prompt fixed annuityor when you "annuitize" your deferred annuityyou get an established fixed amount of cash, typically on a regular monthly basis (similar to a pension plan)

While a variable annuity has the advantage of tax-deferred development, its yearly costs are likely to be much higher than the costs of a common mutual fund. And, unlike a repaired annuity, variable annuities do not provide any assurance that you'll make a return on your investment. Rather, there's a threat that you can actually shed money.

Due to the complexity of variable annuities, they're a leading source of capitalist complaints to FINRA (contingent deferred annuities). Prior to acquiring a variable annuity, very carefully checked out the annuity's syllabus, and ask the person marketing the annuity to clarify every one of the item's functions, bikers, costs and limitations. You ought to additionally know how your broker is being compensated, consisting of whether they're getting a payment and, if so, just how much

Online Annuity Quote

Indexed annuities are complicated monetary tools that have attributes of both taken care of and variable annuities. Indexed annuities typically provide a minimal surefire rates of interest incorporated with a rate of interest connected to a market index. Several indexed annuities are linked to broad, well-known indexes like the S&P 500 Index. Some usage other indexes, consisting of those that represent various other sectors of the market.

Understanding the functions of an indexed annuity can be complex (retire annuity). There are several indexing methods companies use to calculate gains and, due to the fact that of the variety and intricacy of the methods made use of to credit scores interest, it's hard to compare one indexed annuity to another. Indexed annuities are normally classified as one of the complying with 2 types: EIAs provide an assured minimum rate of interest rate (commonly at the very least 87.5 percent of the premium paid at 1 to 3 percent interest), as well as an extra interest rate linked to the efficiency of one or more market index

Prices are as of day and go through change. 5. The S&P 500 Index consists of 500 huge cap supplies from leading firms in leading industries of the united state economy, recording roughly 80% protection of U.S. equities. The S&P 500 Index does not include rewards stated by any of the firms in this Index.

The LSE Group makes no insurance claim, prediction, service warranty or representation either regarding the outcomes to be gotten from IndexFlex or the viability of the Index for the purpose to which it is being put by New york city Life. Variable annuities are lasting financial items made use of for retirement savings. There are charges, expenses, restrictions and threats connected with this policy.

Withdrawals may go through regular revenue tax obligations and if made before age 59 might undergo a 10% IRS charge tax obligation. For prices and complete information, call an economic specialist. This material is general in nature and is being offered educational functions only (two types of annuities). It was not prepared, and is not planned, to resolve the needs, scenarios and/or goals of any kind of certain person or team of individuals.

The syllabus have this and various other details about the product and underlying financial investment alternatives. Please review the prospectuses very carefully before spending. Products and features are offered where authorized. In the majority of jurisdictions, the plan kind numbers are as adheres to (state variations might apply): New York Life IndexFlex Variable AnnuityFP Collection (ICC20V-P02 or it may be NC20V-P02).

Best Deferred Annuity

An earnings annuity starts distributing repayments at a future day of your option. Taken care of deferred annuities, likewise recognized as dealt with annuities, supply stable, guaranteed growth.

The value of a variable annuity is based upon the performance of an underlying profile of market investments. when to buy an annuity. Variable annuities have the advantage of offering more choices in the way your money is spent. This market direct exposure might be required if you're seeking the opportunity to expand your retirement nest egg

This material is for info use just. It should not be counted on as the basis to purchase a variable, taken care of, or prompt annuity or to execute a retired life method. The details given here is not composed or intended as financial investment, tax, or lawful advice and might not be depended on for objectives of avoiding any kind of federal tax fines.

Tax obligation results and the relevance of any kind of item for any particular taxpayer may vary, depending upon the certain set of facts and conditions. Entities or persons dispersing this details are not authorized to give tax obligation or lawful advice. Individuals are motivated to look for details guidance from their individual tax or lawful guidance.

Variable annuities and their underlying variable investment options are offered by syllabus just. Financiers ought to think about the financial investment goals, dangers, fees, and costs meticulously prior to spending. deferred immediate annuity.

Definition Of Immediate Annuity

Please review it prior to you invest or send cash. Repaired and variable annuities are issued by The Guardian Insurance Coverage & Annuity Business, Inc. (GIAC). All warranties are backed exclusively by the stamina and claims-paying capability of GIAC. Variable annuities are released by GIAC, a Delaware company, and dispersed by Park Method Stocks LLC ().

5 Look out for taken care of annuities with a minimum surefire rate of interest of 0%. You will not lose principal, however your money will certainly not expand. You will certainly not obtain all the extra passion that the stock market may make. market value adjusted annuities. The insurance coverage business makes a decision just how much you obtain. Watch out for ads that show high rates of interest.

Some annuities supply a higher assured rate of interest for the first year only. This is called a teaser rate. The rate of interest drops afterwards. See to it to ask what the minimal price is and how much time the high rate of interest lasts. There are various methods to start getting income settlements.

Accumulation Period Annuity

You usually can not take any extra cash out. The major factor to acquire an instant annuity is to get a normal income right away in your retirement. Deferred Annuity: You begin obtaining earnings several years later, when you retire. The primary reason to acquire a deferred annuity is to have your cash grow tax-deferred for some time.

This product is for educational or educational purposes only and is not fiduciary investment guidance, or a safety and securities, investment method, or insurance coverage item suggestion. This material does not take into consideration an individual's very own purposes or scenarios which need to be the basis of any type of investment choice. Investment items may undergo market and other threat factors.

Table of Contents

Latest Posts

Analyzing Fixed Interest Annuity Vs Variable Investment Annuity Everything You Need to Know About Immediate Fixed Annuity Vs Variable Annuity What Is What Is Variable Annuity Vs Fixed Annuity? Pros an

Breaking Down Your Investment Choices A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Benefits of Annuity Fixed Vs Variable Why Choosing the Right Financial Strategy

Analyzing Strategic Retirement Planning Everything You Need to Know About Variable Annuities Vs Fixed Annuities Defining Fixed Vs Variable Annuities Benefits of Variable Vs Fixed Annuity Why Choosing

More

Latest Posts