All Categories

Featured

Table of Contents

Your returns are based on the performance of this index, subject to a cap and a flooring.

This can offer an eye-catching balance for those looking for modest development without the greater danger profile of a variable annuity. Immediate annuities: Unlike repaired annuities that begin with an accumulation phase, prompt annuities start earnings payments virtually immediately after the first investment (or within a year at a lot of). Called an immediate revenue annuity, it is typically picked by retired people who have actually currently developed up their retirement savings are looking for a reputable way to produce regular earnings like an income or pension plan repayment that starts right away.

If you assume a repaired annuity may be the right choice for you, below are some points to think of. Annuities can provide normal, foreseeable income for an established variety of years or the rest of your life. Nonetheless, usually talking, the longer you desire settlements to last, the lower the amount of each settlement.

Survivor benefit: It is very important to consider what will take place to the cash in your fixed annuity if you pass away while there's still a balance in your account. A survivor benefit function allows you to mark a recipient who will receive a defined quantity upon your death, either as a round figure or in the kind of ongoing repayments.

Certified annuities are funded with pre-tax dollars, typically through retired life plans like a 401(k) or IRA. Costs payments aren't thought about gross income for the year they are paid, but when you take income in the distribution stage, the whole amount is normally based on tax obligations. Nonqualified annuities are moneyed with after-tax bucks, so tax obligations have currently been paid on the contributions.

For instance, the Guardian Fixed Target Annuity SM supplies a guaranteed rate of return for three-to-ten year periods (all may not be available at all times). You can choose the time duration that finest fits your retirement period. We can link you with a local financial specialist that can clarify your options for all kinds of annuities, assess the readily available tax obligation advantages, and assist you choose what makes good sense for you.

Analyzing Strategic Retirement Planning A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Annuity Fixed Vs Variable Why Choosing the Right Financial Strategy Matters for Retirement Planning Fixed Interest Annuity Vs Variable Investment Annuity: A Complete Overview Key Differences Between Variable Vs Fixed Annuities Understanding the Rewards of Choosing Between Fixed Annuity And Variable Annuity Who Should Consider Fixed Index Annuity Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Variable Annuity Vs Fixed Indexed Annuity A Closer Look at How to Build a Retirement Plan

Many individuals carefully determine the quantity of money they'll need to live comfortably in retirement and invest their working years conserving for that objective, some still are afraid not having sufficient. This worry casts an also larger darkness on respondents already in or near retired life.

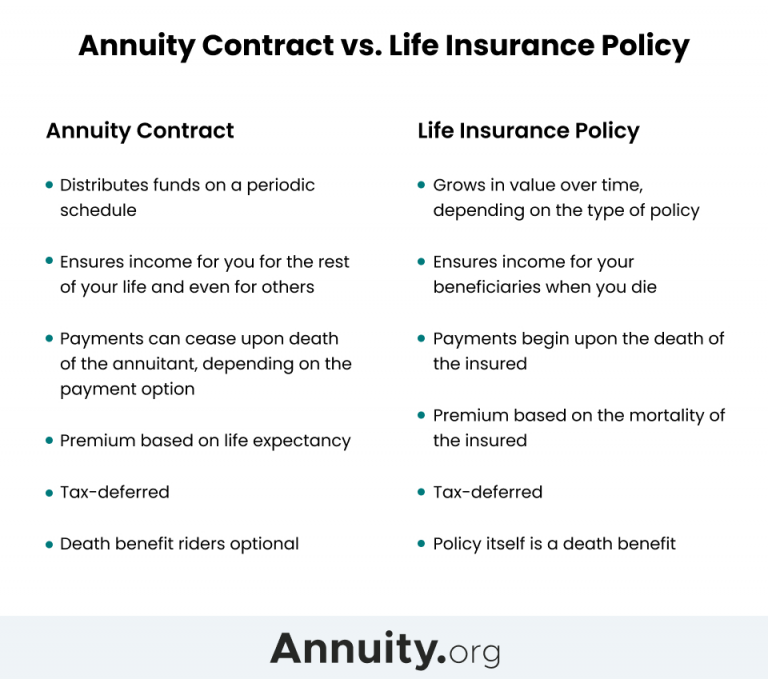

An annuity is a contract in between you and an insurance company that you can acquire by paying a round figure or month-to-month premium. After the accumulation period, the company supplies a stream of payments for the remainder of your life or your picked period. Annuities can be a vibrant lorry to include in your retired life income mix, especially if you're worried regarding running out of cash.

Highlighting the Key Features of Long-Term Investments Key Insights on Variable Vs Fixed Annuities Defining Annuity Fixed Vs Variable Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Fixed Vs Variable Annuity Pros Cons A Beginner’s Guide to Fixed Index Annuity Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

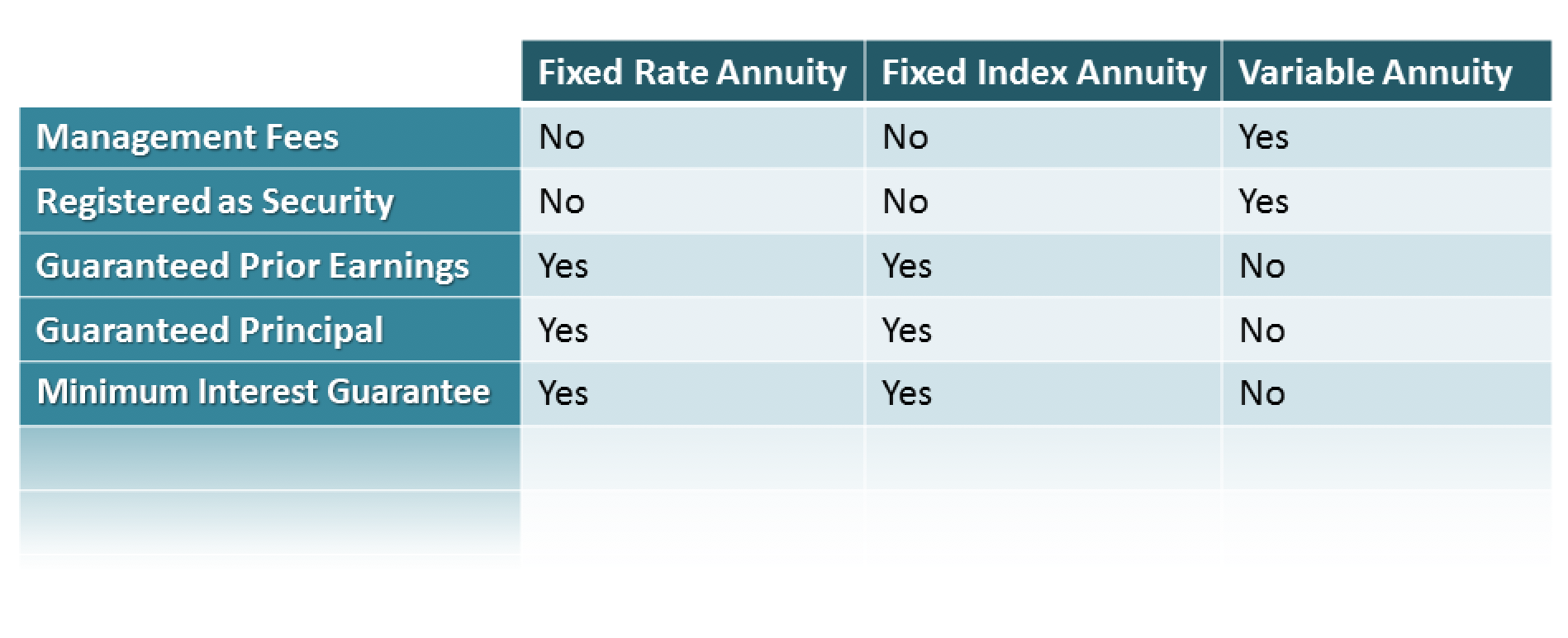

A set annuity is one of the most simple type, offering a reliable and foreseeable earnings stream. The insurance policy firm ensures a fixed rates of interest on your costs, which generates a stable earnings stream over the remainder of your life or a details period. Like deposit slips, these annuities are typically the go-to service for more risk-averse capitalists and are among the most safe financial investment choices for retirement profiles.

Normal repaired annuities might do not have defense from rising cost of living. Fixed annuities have a stated passion rate you gain no matter of the market's efficiency, which may indicate missing out on out on prospective gains.

While you can take part in the market's benefit without risking your principal, fixed index annuities restrict your return. Fixed index annuities can be complex, with numerous functions and alternatives. The minimum rate may not stay on top of rising cost of living, which can decrease your investment's purchasing power. While you can buy various other annuities with a stream of repayments or a swelling amount, prompt annuities call for a round figure.

As with most annuities, you can make a decision whether to receive repayments for a details period or the remainder of your life. Immediate annuities give a stable stream of income you can't outlive.

Right here are 7 questions to ask to aid you discover the ideal annuity. Immediate annuities have a short or no buildup duration, while deferred settlement annuities can last over 10 years.

Highlighting the Key Features of Long-Term Investments A Closer Look at Fixed Index Annuity Vs Variable Annuity Defining the Right Financial Strategy Benefits of Fixed Index Annuity Vs Variable Annuity Why Choosing the Right Financial Strategy Is Worth Considering How to Compare Different Investment Plans: A Complete Overview Key Differences Between Variable Vs Fixed Annuity Understanding the Rewards of Variable Annuity Vs Fixed Indexed Annuity Who Should Consider Fixed Index Annuity Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Different annuities have different charges. Understand the costs linked with your selected annuity. Inspect with monetary rating agencies like Requirement & Poors, AM Best, Moody's, and Fitch.

Annuities can be complicated and complicated, even for knowledgeable capitalists. That's why Bankers Life provides individualized support and education throughout the process. We specialize in comprehending your needs and guiding you toward services to aid you achieve your ideal retired life.

Each person should look for specific guidance from their own tax obligation or legal advisors. To identify which financial investment(s) may be proper for you, please consult your economic professional prior to investing.

Both IRAs and delayed annuities are tax-advantaged methods to prepare for retired life. They work in very various means. As discussed above, an individual retirement account is an interest-bearing account that provides tax obligation advantages. It is like a basket in which you can place various kinds of financial investments. Annuities, on the various other hand, are insurance coverage items that transform some savings right into ensured settlements.

Check out on for even more explanation and comparisons. A private retired life account (IRA) is a sort of retirement savings lorry that allows investments you make to expand in a tax-advantaged means. They are a great way to conserve lengthy term for retirement. An IRA isn't an investment per se.

Analyzing Strategic Retirement Planning Everything You Need to Know About Variable Annuity Vs Fixed Annuity Breaking Down the Basics of Investment Plans Benefits of Fixed Index Annuity Vs Variable Annuities Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: How It Works Key Differences Between Different Financial Strategies Understanding the Risks of Long-Term Investments Who Should Consider Variable Vs Fixed Annuity? Tips for Choosing the Best Investment Strategy FAQs About Fixed Index Annuity Vs Variable Annuity Common Mistakes to Avoid When Choosing What Is A Variable Annuity Vs A Fixed Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Vs Variable Annuity

Commonly, these investments are supplies, bonds, common funds, or also annuities. Each year, you can invest a certain quantity within your IRA account ($6,500 in 2023 and subject to transform in the future), and that investment will grow tax cost-free.

When you withdraw funds in retired life, however, it's exhausted as regular earnings. With a Roth individual retirement account, the cash you put in has actually already been tired, yet it expands tax obligation free throughout the years. Those incomes can then be withdrawn tax obligation complimentary if you are 59 or older and it has gone to least five years given that you first added to the Roth IRA.

Analyzing Fixed Income Annuity Vs Variable Annuity Everything You Need to Know About Financial Strategies Breaking Down the Basics of Fixed Vs Variable Annuities Features of Pros And Cons Of Fixed Annuity And Variable Annuity Why Choosing the Right Financial Strategy Can Impact Your Future Variable Annuity Vs Fixed Indexed Annuity: How It Works Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Variable Annuities Vs Fixed Annuities? Tips for Choosing Indexed Annuity Vs Fixed Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Pros And Cons Of Fixed Annuity And Variable Annuity

No. IRAs are retired life financial savings accounts. Annuities are insurance policy items. They operate in completely different means. You can sometimes put annuities in an individual retirement account though, or utilize tax-qualified IRA funds to purchase an annuity. There may be some crossover, yet it's the kind of crossover that makes the essential differences clear.

Annuities have been around for a very long time, however they have come to be more common lately as people are living longer, fewer people are covered by standard pension plan strategies, and preparing for retired life has come to be more crucial. They can frequently be incorporated with other insurance coverage items like life insurance policy to create complete defense for you and your family members.

Table of Contents

Latest Posts

Analyzing Fixed Interest Annuity Vs Variable Investment Annuity Everything You Need to Know About Immediate Fixed Annuity Vs Variable Annuity What Is What Is Variable Annuity Vs Fixed Annuity? Pros an

Breaking Down Your Investment Choices A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Benefits of Annuity Fixed Vs Variable Why Choosing the Right Financial Strategy

Analyzing Strategic Retirement Planning Everything You Need to Know About Variable Annuities Vs Fixed Annuities Defining Fixed Vs Variable Annuities Benefits of Variable Vs Fixed Annuity Why Choosing

More

Latest Posts